[Deal level Private Credit Decisioning] Mark to Model Pricing

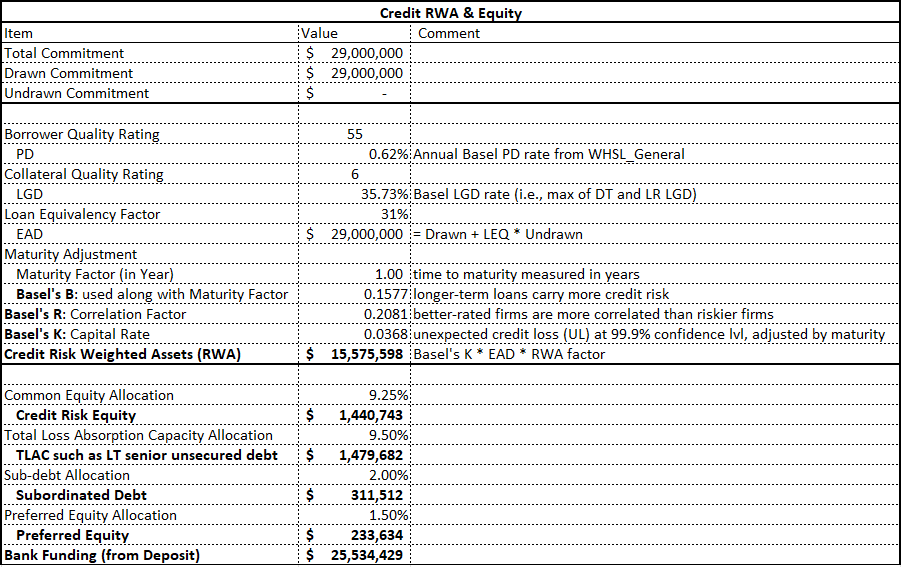

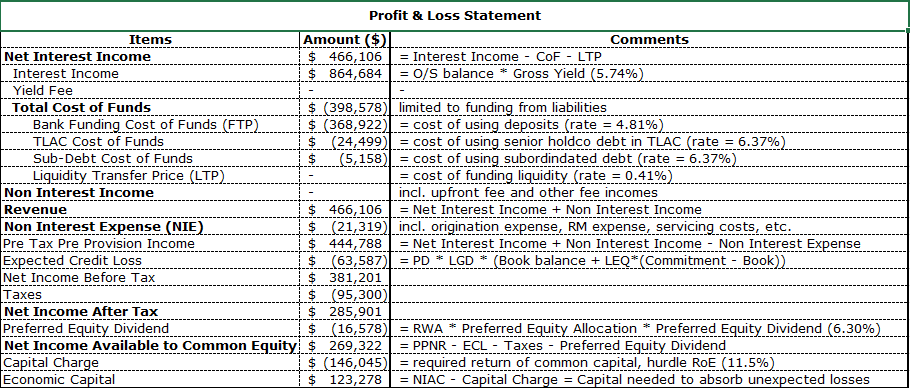

An analytical framework for evaluating the profitability of credit investment has been outlined on the previous post. We studies a Mark-to-Model pricing model that translates different inputs into a projected return. This is fundamental to assessing whether a credit investment is profitable relative to its risks and to other asset classes.

High-Level Design

P/L Statements

Inputs / Rates / Factors