[Leveraged Finance] Quick Overview

Leveraged Finance or LevFin refers to debt financing of highly levered / speculative-grade companies. It comprises both leveraged loans and high-yield bonds. In particular, Leveraged Loans (LL) are mainly used for leveraged buy-outs (LBOs), mergers and acquisitions (M&A), recapitalisation or refinancing of debt.

Debt issuances often receive a rating from major credit rating agencies, such as S&P Global Ratings (S&P). Per S&P's analysis [1], among rated corporates, speculative-grade represents 51% of issuers, despite they just account for 22% of rated debt. For those non-rated, they are often comparable to speculative grades. That's, there's a huge universe of companies without investment-grade ratings.

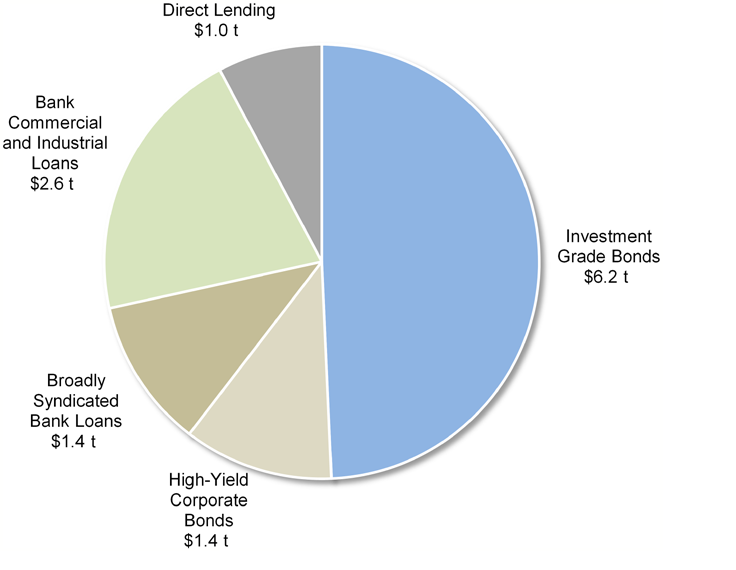

Today, LevFin makes up at least 30% of US corporate debt market

Stephen Nesbitt [2] estimates the US corporate debt market totaled approximately $12.6 trillion in Q1 2022, which includes $6.2T in investment-grade (IG) bonds. The remainder of investment grade debt, in loan form, is encompassed within the $2.6T Bank Commercial and Industrial (C&I) Loans [3]. It's unclear, however, what the distribution of C&I loans between IG and below-IG looks like, as it's a strategic decision that differs for each bank.

In the broadest sense, the LevFin consists of $1.4T in High-Yield Corporate Bonds (HY), $1.4T in Broadly Syndicated Loans (BSL), $1.0T in Direct Lending (aks Private Credit), along with a leveraged portion of $2.6T in Bank C&I loans.

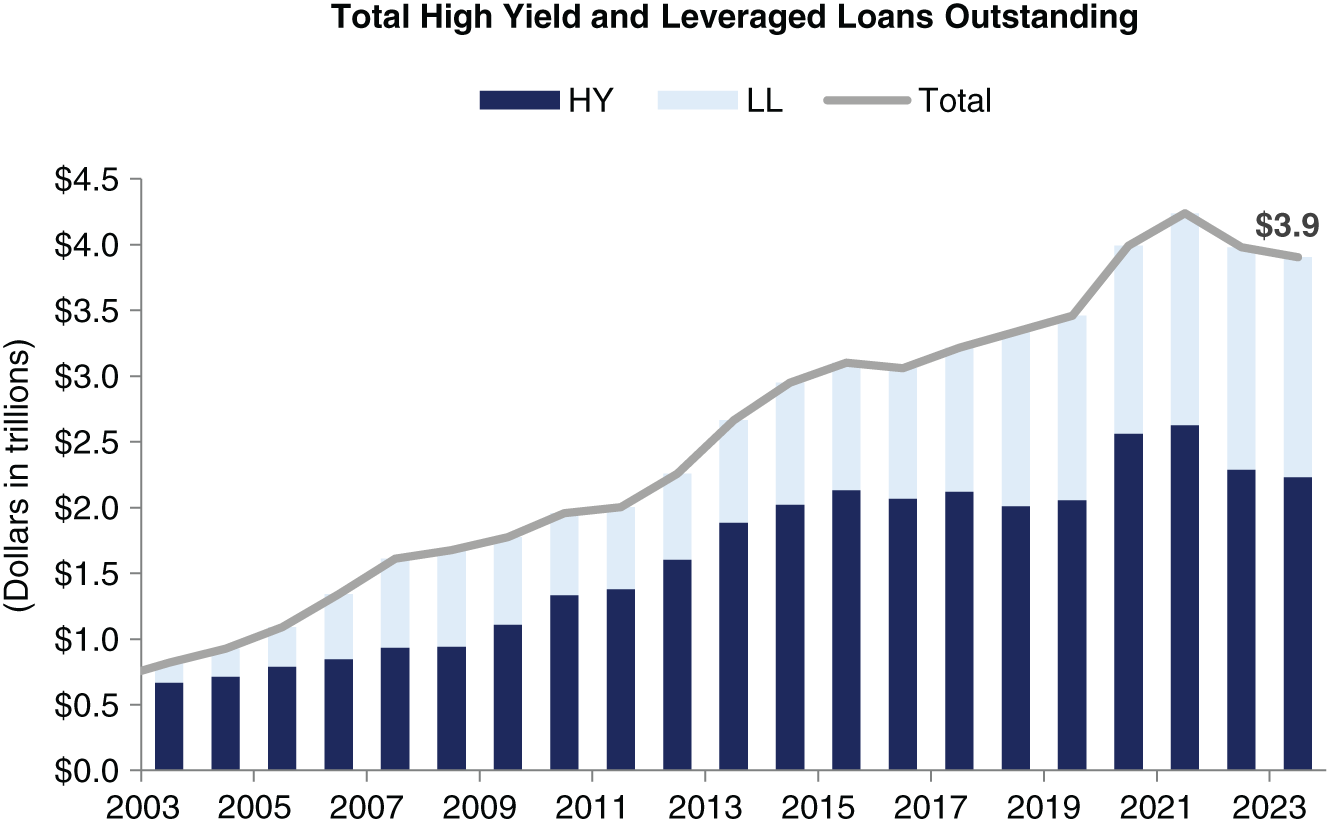

Leveraged Loans outgrow HY bonds in recent years, gaining traction and momentum

As the size of C&I leveraged loans is not publicly available, some narrower measures of LevFini are often used. For example, Nini and Smith [4] and Fidelity restrict the LevFin market to large borrowers (HY + BSL), while Gatto [5] argues the private credit market for middle-market borrowers is also an essential component (LevFin = HY + BSL + Direct Lending). Here, we're sharing the historical trend of LevFin using Gatto's version.

Per Gatto's account, The non‐investment grade debt markets have grown by roughly 7x over the last 20 years, driven by the growing acceptance of more-levered companies, the growth of private equity, and investor demand for a higher rate of return. Nesbitt even suggests that direct lending is now a real challenger to the traditional bank C&I loan business and has the potential to claim a sizable market from its competitors. The narrative seems to jibe well with the WSJ report [6].

LevFin: Loan vs Bond

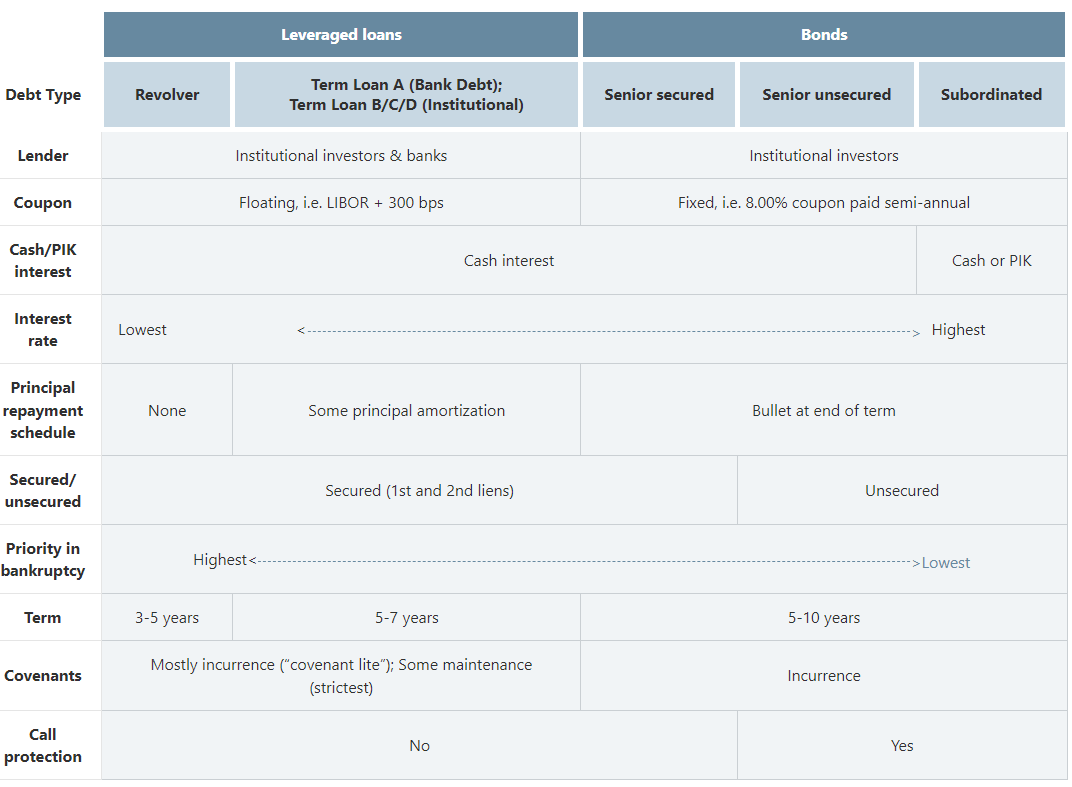

[7] makes a nice chart (below) to highlight the differences between leveraged loans and HY bonds.

Generally, debt seniority is ranked, from high to low, by ABL Revolver > Secured loans and bonds > Senior unsecured debt > Subordinated bonds/Mezzanine Debt. Therefore, leveraged loans are often senior to HY bonds.

Leveraged loans can be underwritten by banks and private debt asset managers. Their focus and business models, however, differ. Banks typically guarantee the entire commitment and then syndicate the loan (e.g., sell to institutional investors). With that, banks earn lucrative fees, but also take the distribution risk (i.e., unable to sell loans, especially when liquidity dries up). On the other side, private credit funds invest in the debt of small and medium-sized companies. They can either buy from banks or provide debt financing directly to companies (Direct Lending).

Lending to leveraged borrowers can be structured into different risk-return profiles such as Revolver, TLA, and TLB. Banks are major investors in Revolver and Term A due to their risk appetite and regulation. Compared to TLB, TLA has smaller spreads, stricter covenants, and more even amortization schedules.

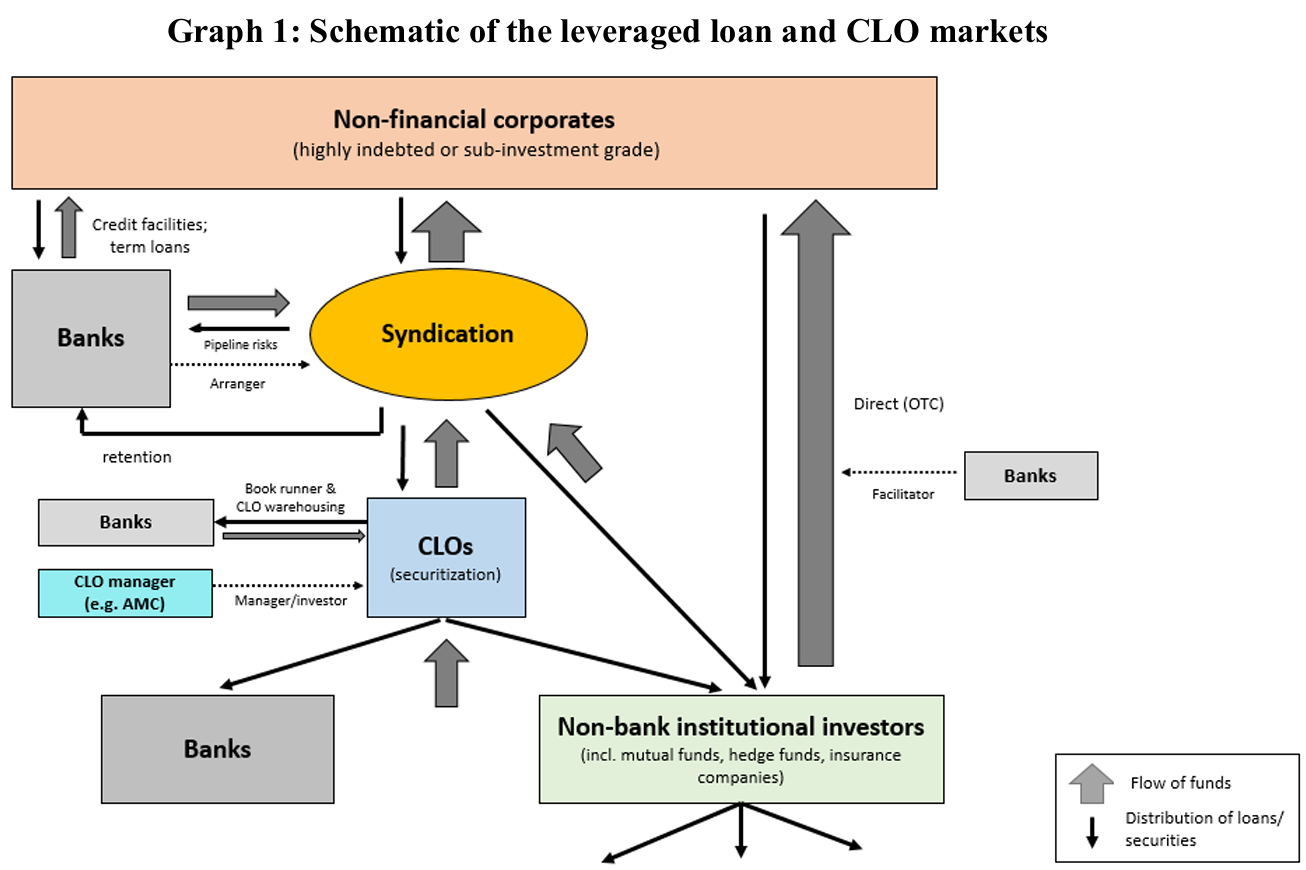

Banks' role in LevFin

Banks perform a variety of functions in the leveraged loan (and CLO) markets, as summarized by [8].

- Banks as Arrangers/Structurers: structure, arrange and underwrite leveraged loans, directly or indirectly.

- Banks as Distributors: lead/participate in the syndication process (risk-sharing tool) that avoids overly high exposure to a single debtor, and distribute most of of non-amortising loans with a bullet payment at maturity (aka TLB/C/D institutional loans).

- Banks as Investors: provide funds structured as revolving credit facilities or "revolver" and usually retain only a portion of the term loans (amortising loans aka TLAs).

Reference

[1] S&P Global, 2023, Credit Trends: Global State Of Play: Debt Growth Diverging By Credit Quality

[2] Stephen L. Nesbitt, 2023, Private Debt: Yield, Safety and the Emergence of Alternative Lending

[3] S&P Global, Q2 2023, US banks' C&I lending in Q2 2023

[4] Nini and Smith, 2023 WP, Leveraged Finance

[5] Michael Gatto, 2024, The Credit Investor's Handbook: Leveraged Loans, High Yield Bonds, and Distressed Debt

[6] Matt Wirz from WSJ, 2024, The New Kings of Wall Street Aren’t Banks. Private Funds Fuel Corporate America.

[7] WallStreetPrep, 2023, Leveraged Finance Guide

[8] Finanical Stability Board, 2019, Vulnerabilities associated with leveraged loans and collateralised loan obligations