[Crypto] Stablecoins: TerraUSD and Its Epic Run

The rise and fall of Terra's algorithmic stablecoin system is "epic"; at the peak, it was the third largest stablecoin by market cap ($18BN), but was wiped out just in the span of days.

This article details a timeline of Terra's journal from its underdog start as a payment to a $60 billion crypto ecosystem to one of the biggest failures in crypto.

Below pinpoints key products and events:

| Date | Product | Event | Comments |

|---|---|---|---|

| 2018/01 | Terra Network | Terraform Labs launch the Terra network, supported by 15 e-commerce companies needing payment solution | |

| 2019/01 | LUNA | sold privately to investors such Binance, Huobi, and OKex | |

| 2020/07 | Anchor | a saving/lending protocol launches to secure the demand by promising a high yield on Terra deposits | |

| 2020/09 | UST or TerraUSD | a stablecoin is publicly announced to address the scaling issue faced by the dai. | |

| 2020/12 | Mirror | a synthetic stock protocol launches to stimulate the public interest in Terra money by enabling Terra users to own fractional amounts of an assets. | |

| 2020/05 | UST Depeg | the first serious de-pegging on 5/23 and 5/24. | |

| 2022/01 | Luna Foundation Guard | LFG launches with a mandate to build reserves supporting $UST peg and starts to buy Bitcoin to shore up UST's reserve system on a ongoing basis | |

| 2022/03 | “Curve Wars” | TerraLab started an attack on dai, aiming to knock out the rival in 3pool and create a new 4 pool (USDC, USDT, UST and FRAX) |

What is Terra?

Warning: there're tons of jargon

Terra builds upon the Cosmos, one kind of Layer-1 blockchain protocols. Other popular Layer 1 blockchains include Bitcoin, Ethereum, Solana, and Avalanche.

Blockchain is a distributed ledger of transactions that enables exchange of value without the need for a trusted third-party. Consensus Mechanism and Smart Contract can help achieve the objectives including

- reduce the need in trusted intermediation (e.g., banks)

- reduce arbitrations and enforcement costs (e.g., money wire fees)

- reduce malicious and accidental exceptions (e.g., fraud / human error)

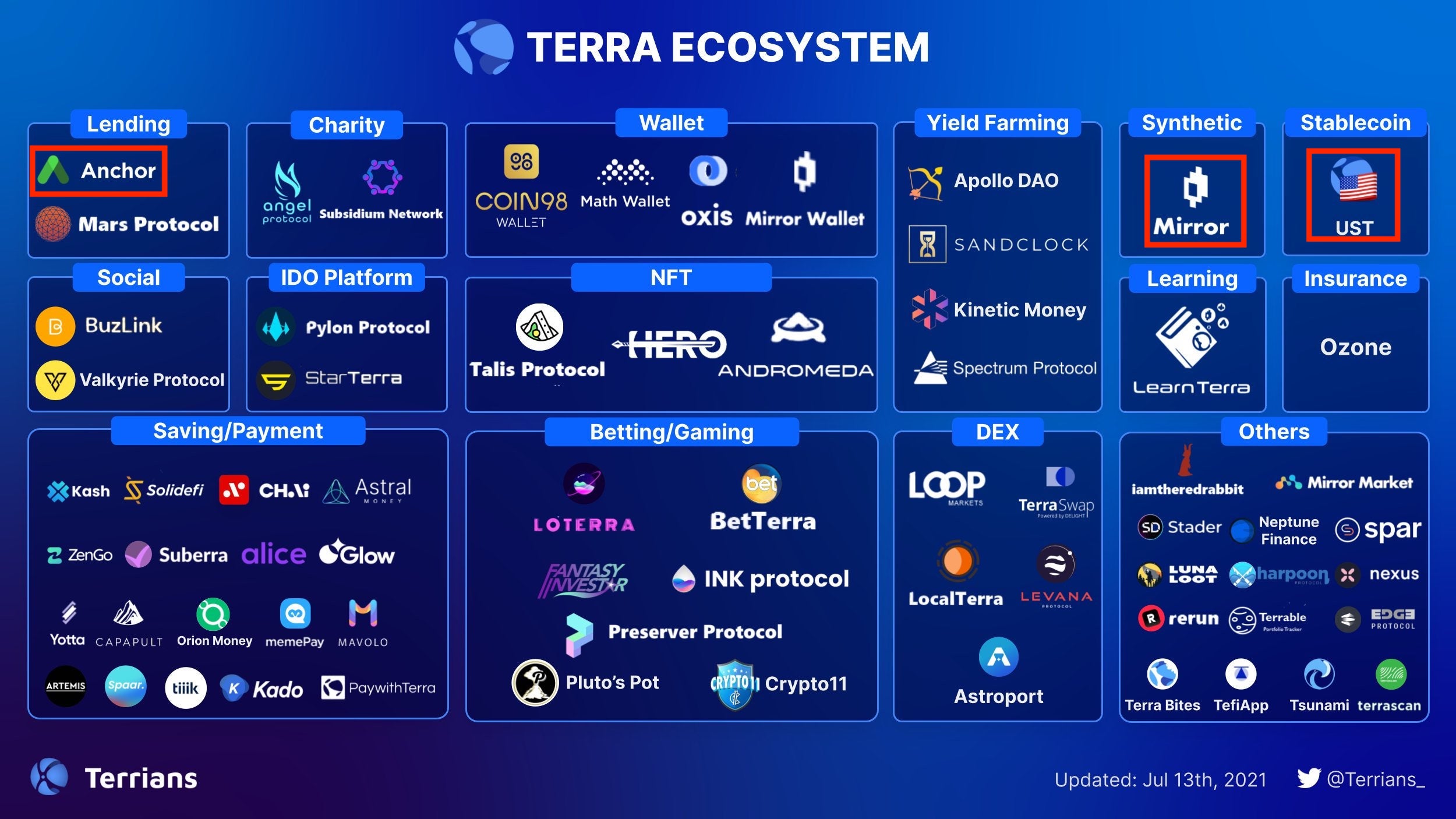

In the Terra Ecosystem, a few core products are driving its growth;

-

TerraUSD, or UST: a stablecoin as a private money;

-

Anchor: a lending/borrowing protocol as a bank/money market fund;

-

Mirror: an investing protocol as a brokerage firm/Stock Exchange.

-

Astroport: a decentralized exchange mainly on-chain.

Why Terra was hot: Users' perspective

By users, i mean the stablecoin UST holders, who use or plan to use UST to purchase goods and/or services.

Hook: Anchor, a dApp on Terra platform, promised the industry-leading 20% return for deposits made in UST. As a reference, the return have never risen above 12% historically for depositing another stablecoin Dai on Compound.

Under the hood: decentralized finance (DeFi) needs stablecoin, and Terra's UST is a stablecoin. It is a truly de-decentralized token that depends on arbitrage mechanism, rather than central governing organization, to stabilize the token's price at the promised value. This feature gained the trust of the decentralized finance (DeFi) community.

Behind the scene: Luna Foundation Guard (LFG) devoted to shore up / defend the UST peg. One key event is LFG raised $1 billion to form Bitcoin reserve for UST, led by Jump Crypto and Three Arrow Capital (3AC). Their plan is to boost the public confidence in UST since the Bitcoin reserve to UST is like gold to gold-backed currency.

What's crypto version of FDIC insurance to bank deposits???

Why Terra was hot: Investors/Miners' perspective

By Investors, I mean the LUNA holders, who stake their LUNA coins in Terra network for its operations/growth/governance.

Investors invest Terra by staking LUNA in the network, similar to buying equity of a public-traded company. Like public companies pay dividends, the Terra network is rewarding these staked coin in two forms.

- Gas Fee: the use of services hosted on Terra Network. More uses mean higher revenue coming from fees. (As of Feb-2022, gas revenue is around 1% to 2% of the staking APR. )

- Oracle Rewards Distribution: it comes from the swap fee charged when someone burns LUNA to create UST or vice versa. It's like exchange fee charged by banks. Investors are rewarded every vote periods by a fixed portion of coins in the oracle pool.

See more details in this link.